Introduction

With technology being a foundation of modern organizations, and mergers and acquisitions expected to grow in the years ahead, the impact enterprise architecture plays in ensuring post-merger integration activities run smoothly has become readily apparent to business leadership. As a discipline, enterprise architecture (EA) is equally dedicated to the worlds of IT and business. EA’s goals are to offer a holistic overview of an enterprise, one with every business capability mapped alongside its underpinning technologies, to lead rather than merely guide strategic transformations.

In M&A, enterprise architects are ideally positioned to collaborate and assess, rationalize, and blend technology landscapes in a best-fit manner for the future of the combined enterprise. The EA team can help in the quick and secure integration of IT landscapes by focusing on transparently recording the technologies in both companies. This provides a basis for decision-making and generates faster time-to-value from post-merger integration efforts.

What is Post-Merger Integration (PMI)?

Post-merger integration is the process of unifying two entities and their assets, people, tasks, and resources in a manner that creates the most value for the future of the enterprise by realizing efficiencies and synergies.

From an IT perspective, PMI or acquisition integration is a complex process requiring the leadership of enterprise architects to ensure a smooth process. According to the 2021 LeanIX M&A Report, nearly 90% of EAs are involved in post-merger integration, with the following use cases named as most prevalent.

Ideally, enterprise architects will be included in the due diligence phase of M&A, but all too often they are left to gather the pieces and create a harmonized IT landscape in the wake of a deal. As the intermediary between business and IT leadership, EAs are able to define key objectives and build the PMI plan based on the corporate strategy.

4 steps to PMI - acquisition integration success

Like any successful team, EAs need to be supported by technology that will maximize their value to the organization. Using a leading SaaS-based solution, like the LeanIX Enterprise Architecture Management Platform, these teams can easily overcome the technical challenges associated with mergers and acquisitions and hasten the transition from current to future-state architectures.

Follow these 4 steps to ensure your M&A integration is a success with LeanIX. Of note, the reports and views below are built to be utilized throughout the entire EA practice but are highlighted here in relation to PMI activities.

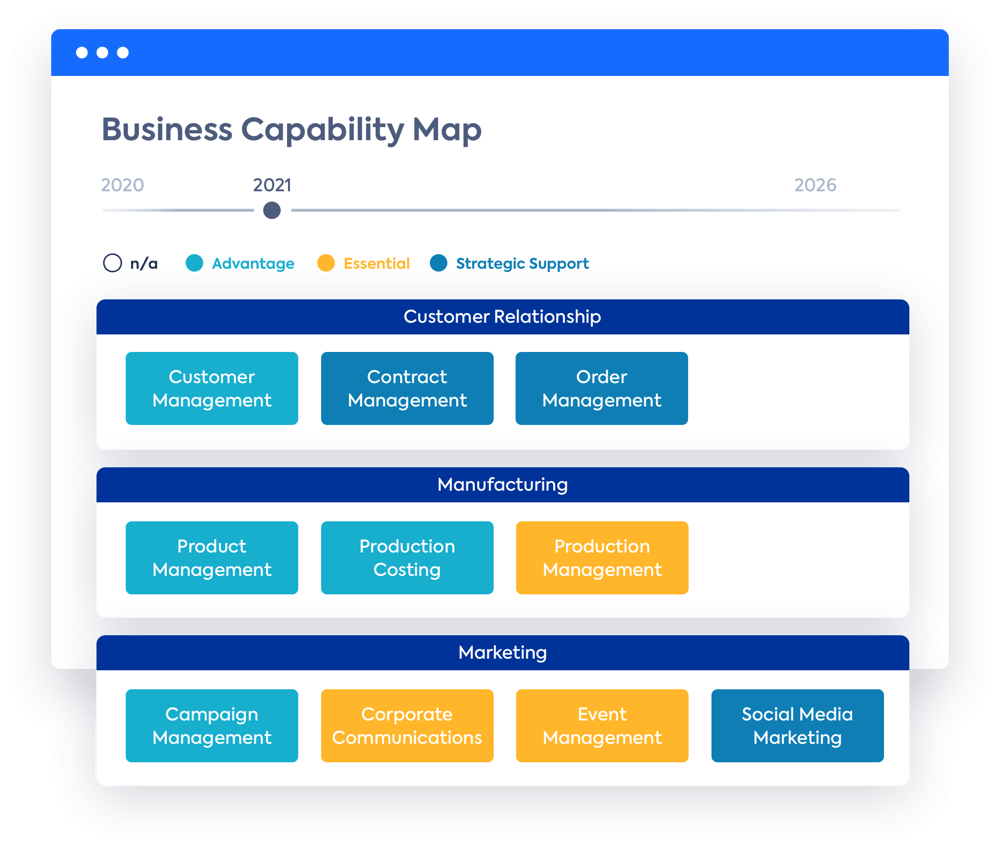

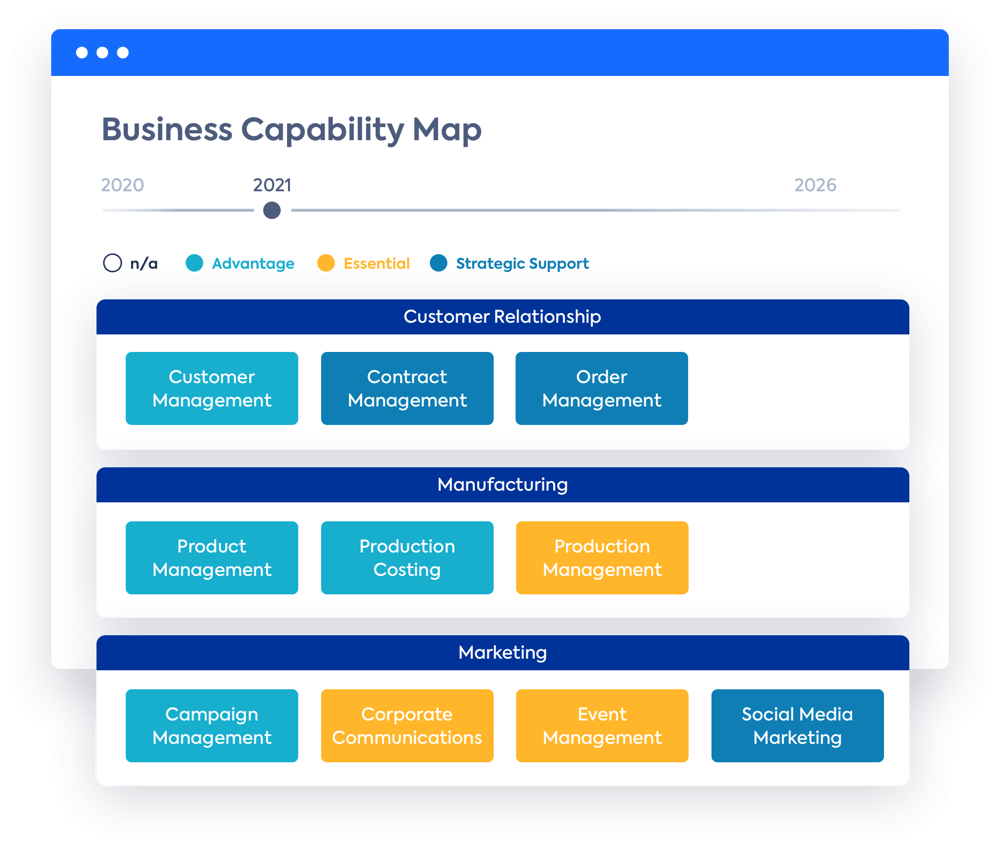

Step 1. Develop a joint business capability map based on the corporate strategy

A core principle of enterprise architecture is understanding the baseline capabilities of a business. In other words, what an organization needs in order to perform its core functions. Business capability models must be built for each organization, and then combined to derive a joint business capability map. This is the first and most critical step of any successful PMI as it will establish a common language for teams to work from (see Figure 1).

Figure 1. Business Capability Map within LeanIX

Source: LeanIX GmbH

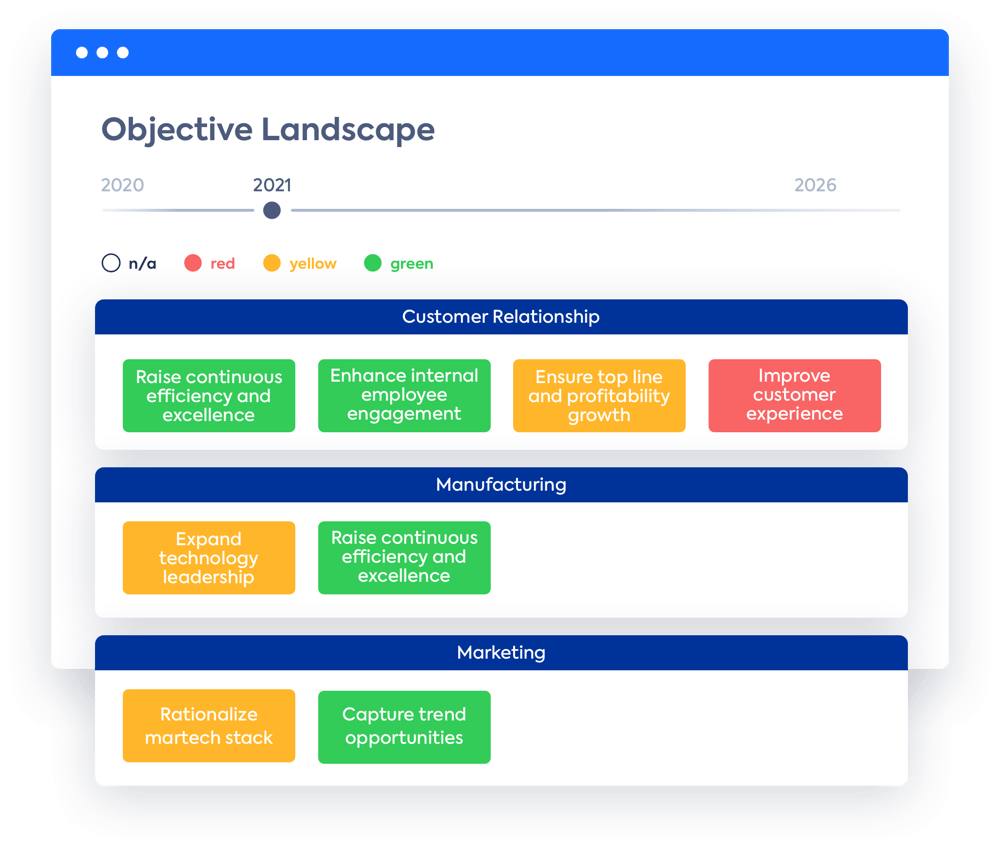

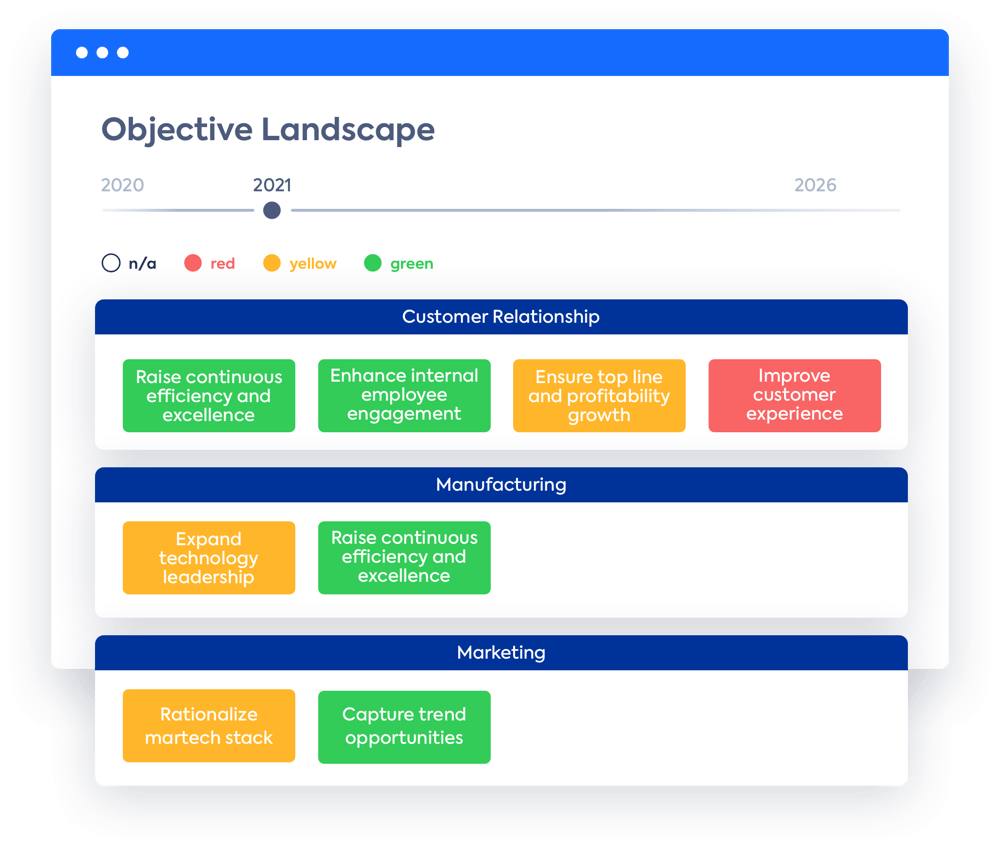

Once a joint business capability map is built, the organizations can assess where there are redundancies and gaps. The corporate strategy and goals of the merger or acquisition integration must serve as a guide for the analysis of, and action plans surrounding, current and future business capabilities. From there, teams can begin diving into the underlying technologies to make decisions regarding key objectives (see Figure 2).

Figure 2: LeanIX Objective Landscape by Business Capability

Source: LeanIX GmbH

LeanIX has created a template to help businesses get started in creating their own capability maps. Click here to get started.

Step 2. Create full transparency of the new application landscape

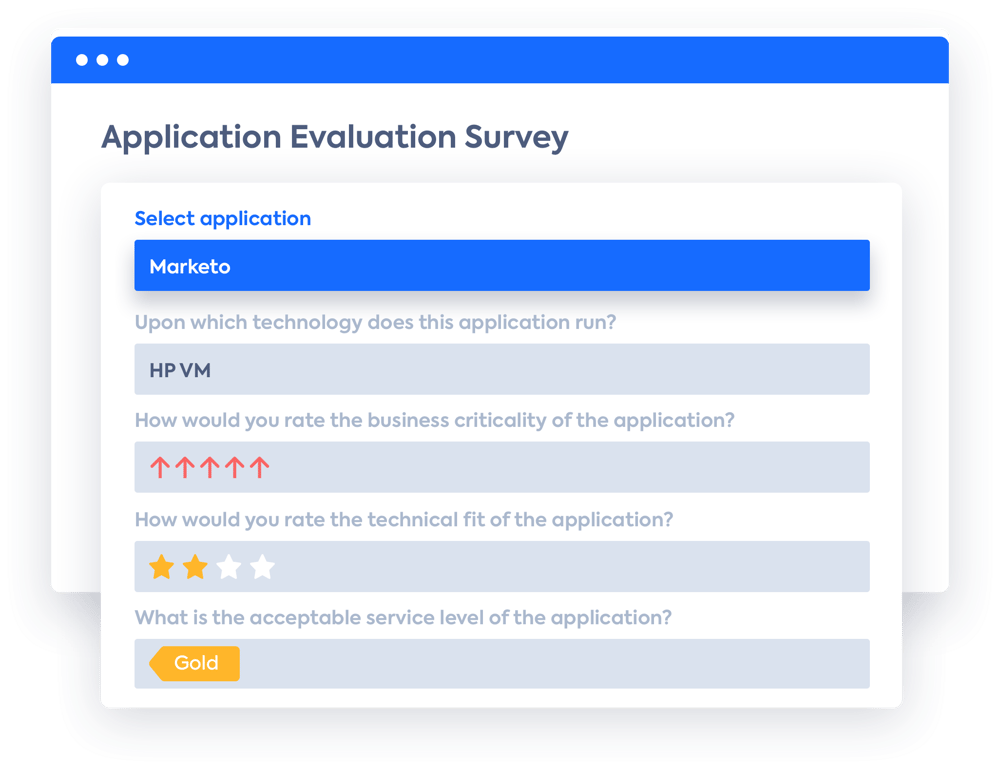

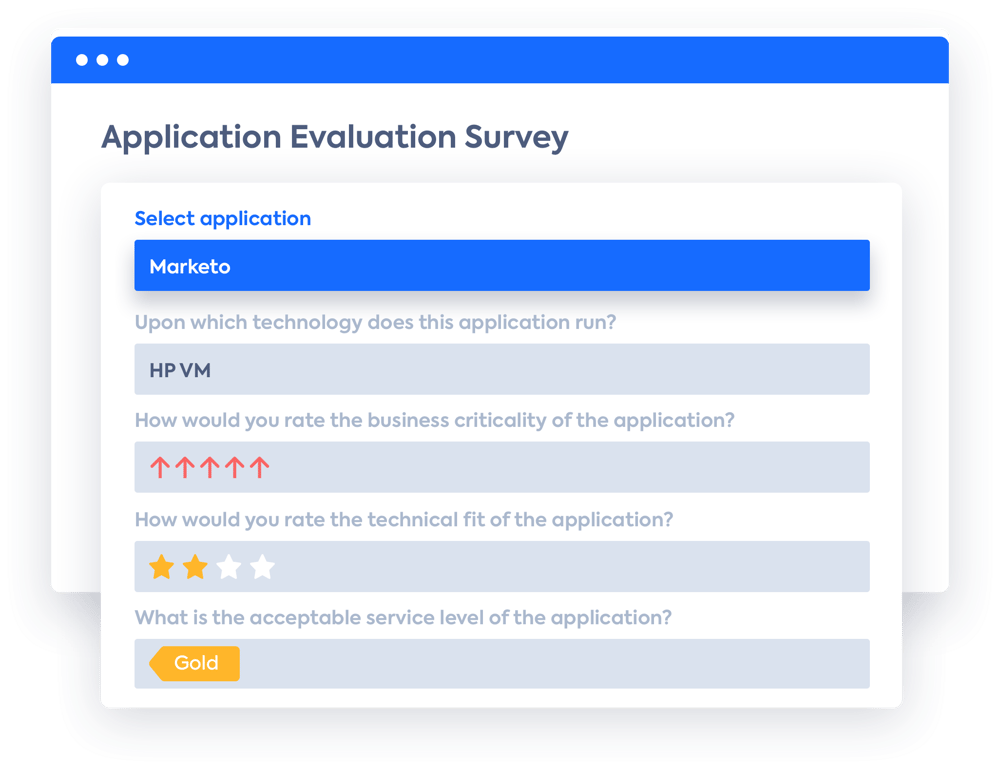

Applications are the backbone of business capabilities. In this step, enterprise architects must create a 360-degree view of all applications to complete the picture of the current-state architecture.

After the information is centralized, EAs should analyze each application by their usage and cost metrics to paint an even clearer picture. Business stakeholders should be brought into the fold via application evaluation surveys that evaluate the technical and functional fit of software running in the ecosystem (see Figure 3).

Figure 3. LeanIX Application Evaluation Survey

Source: LeanIX GmbH

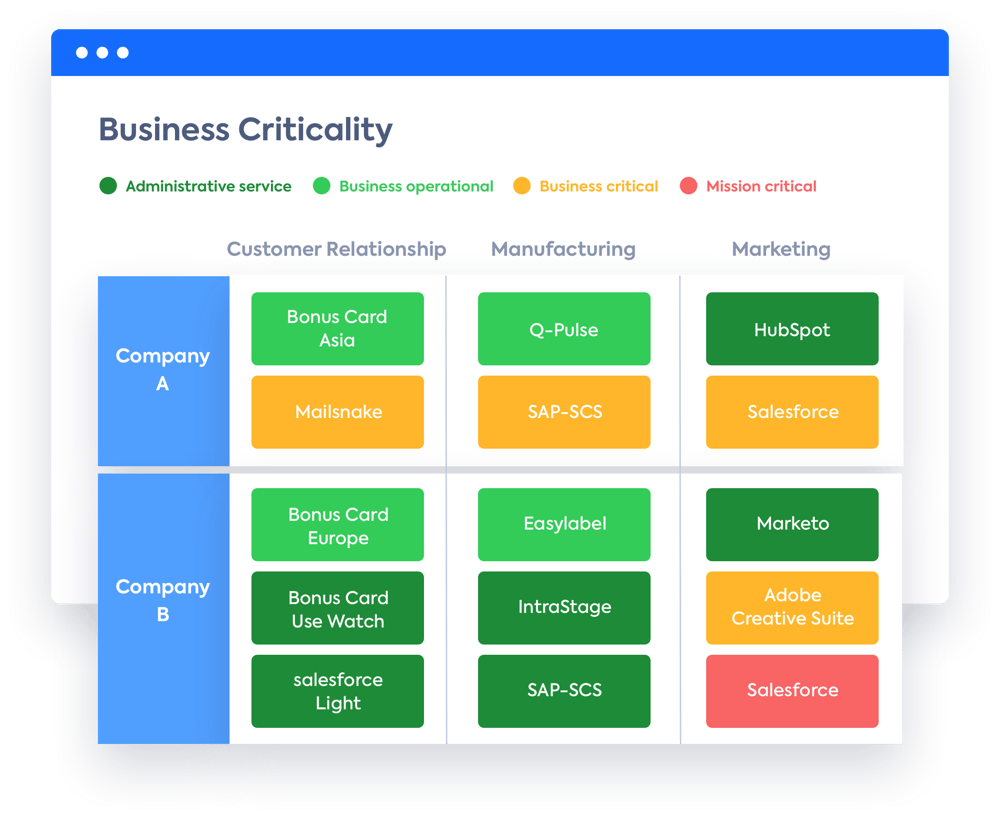

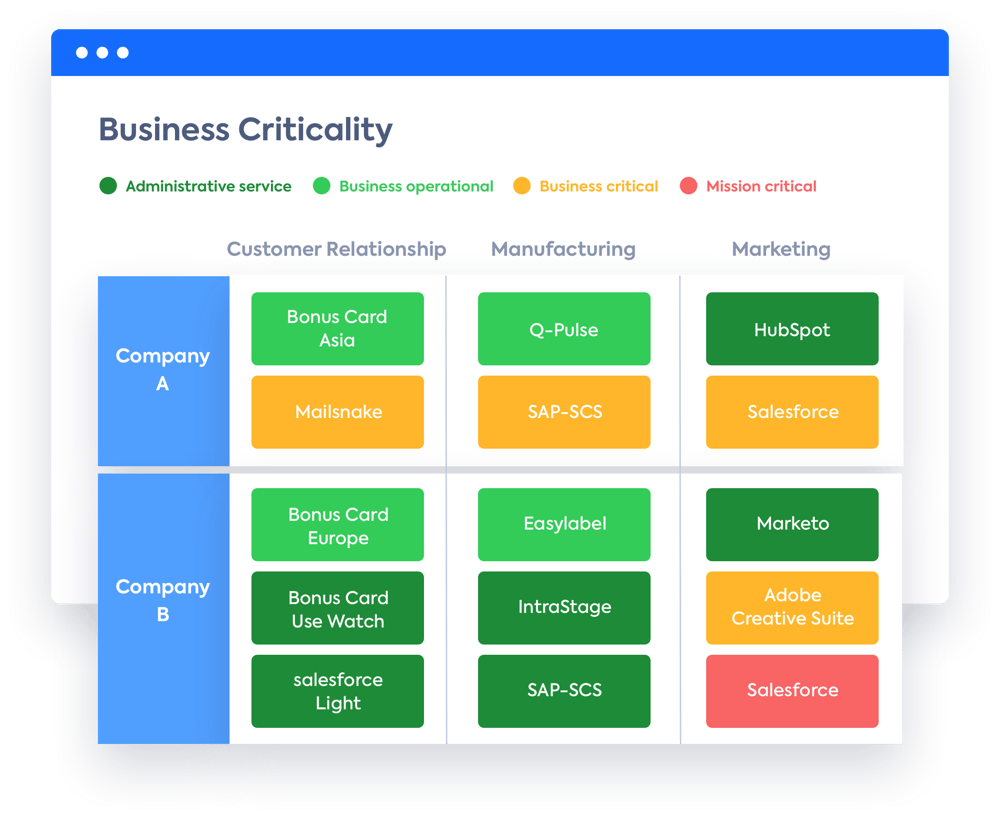

Business capabilities should also be evaluated for their current and future maturity level. Teams can then further dissect the application landscape based on their business criticality, their integrations, and dependencies (see Figure 4).

Figure 4. LeanIX Application Matrix by Business Criticality

Source: LeanIX GmbH

Step 3. Define the best way forward for each application

The time has come to determine how to merge the application landscape and create a target architecture. Teams must align to decide on the best course of action that most closely fits the corporate strategy — e.g., taking a “best of both worlds” vs. “align on major platforms” vs “winner takes all” approach.

It’s at this point that a decision must be made with regard to the fate of existing applications. Application rationalization should be completed in stages, with a focused scope on what will yield the best results, for the most vital capabilities.

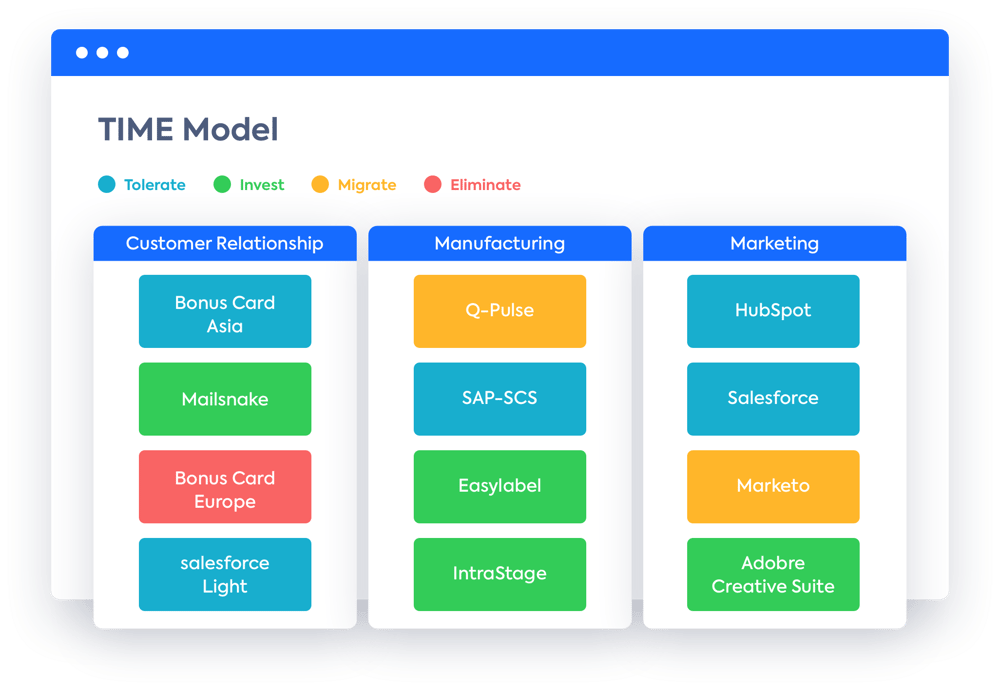

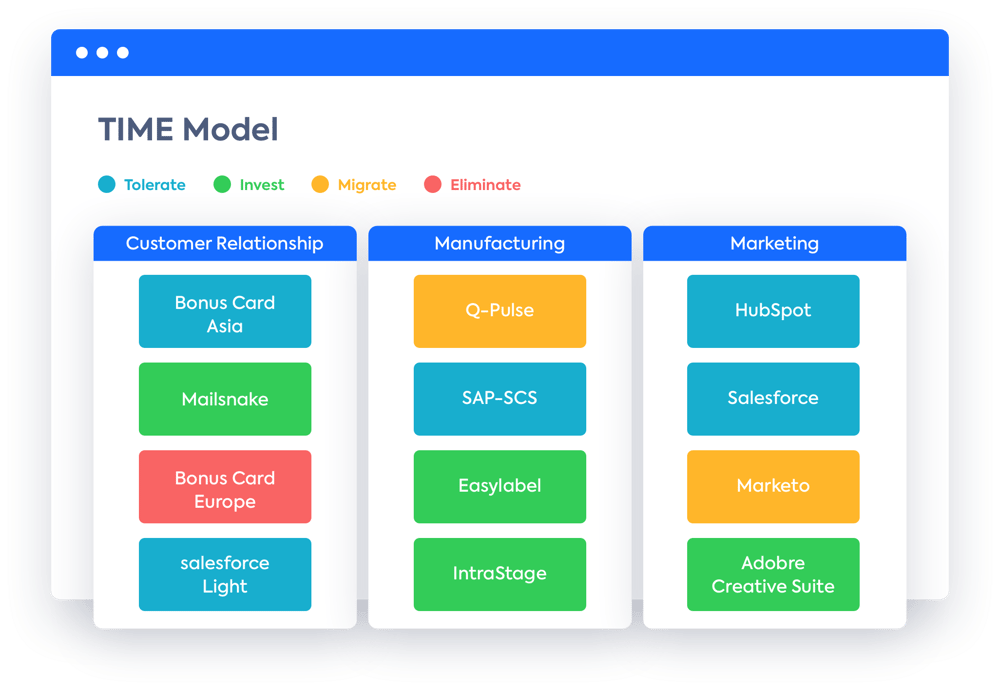

A good technique to drive this effort is Gartner’s TIME model, where stakeholders determine – based on defined criteria – if applications should be tolerated (T), invested in (I), migrated (M), or eliminated (E). LeanIX tags allow EAs to label applications by their TIME-model designation and visualize that across existing reports (see Figure 5).

Figure 5. LeanIX Application Landscape with TIME Model View

Source: LeanIX GmbH

If executed properly, in measured stages, application rationalization can help organizations realize millions of dollars in savings per annum. These savings not only help to offset the capital investment of a merger or acquisition, but they also position the newly formed enterprise for innovation and success moving forward.

Step 4. Develop application roadmap and track implementation

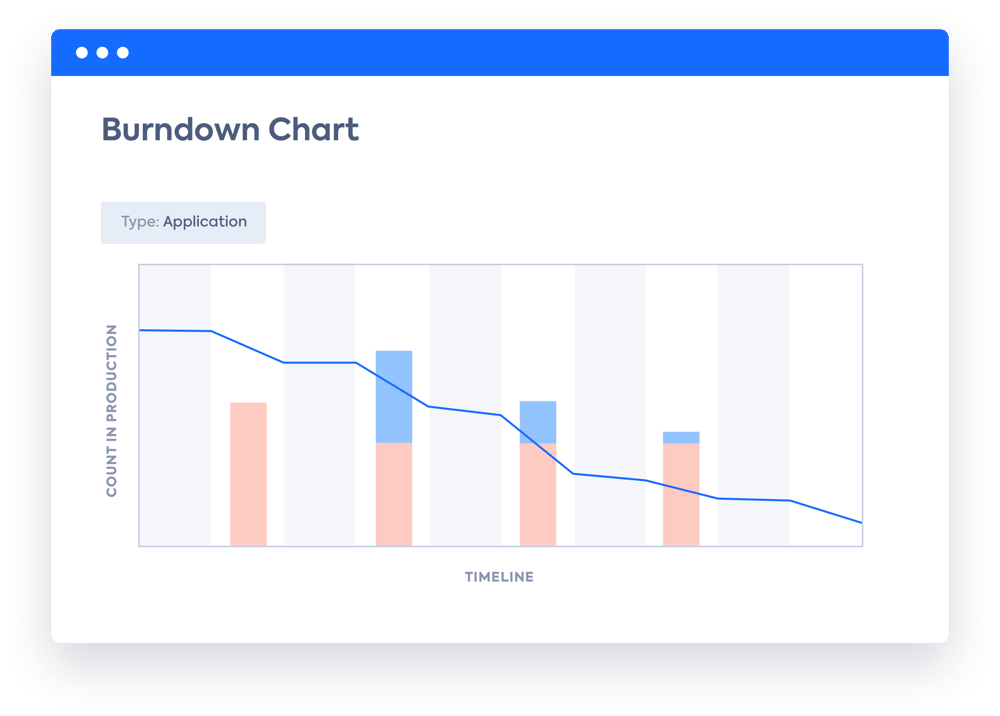

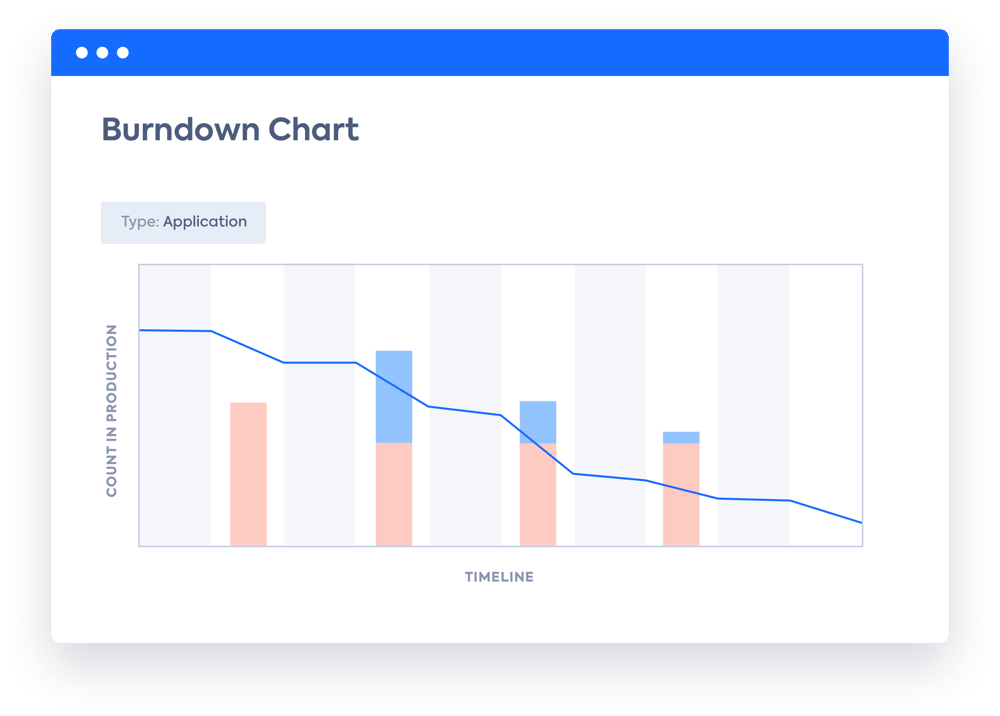

Rationalization activities are underway and EAs should begin tracking the burndown of the application portfolio (see Figure 6). They are now responsible for executing the post-merger integration.

Figure 6. Application Burndown Chart

Source: LeanIX GmbH

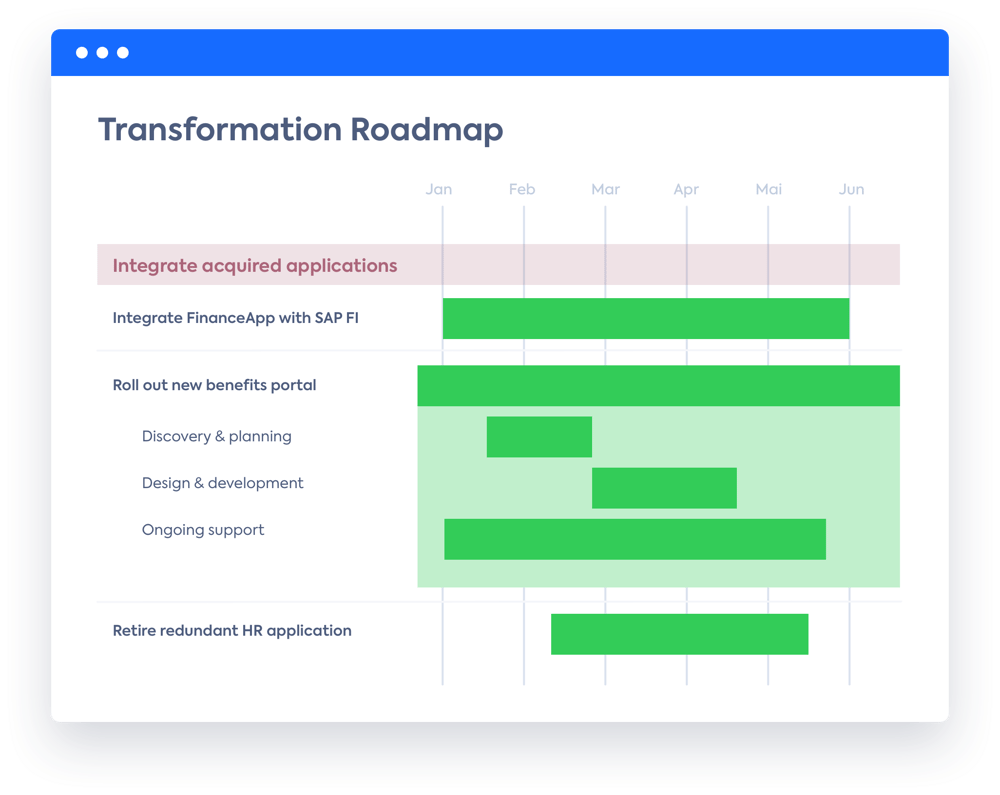

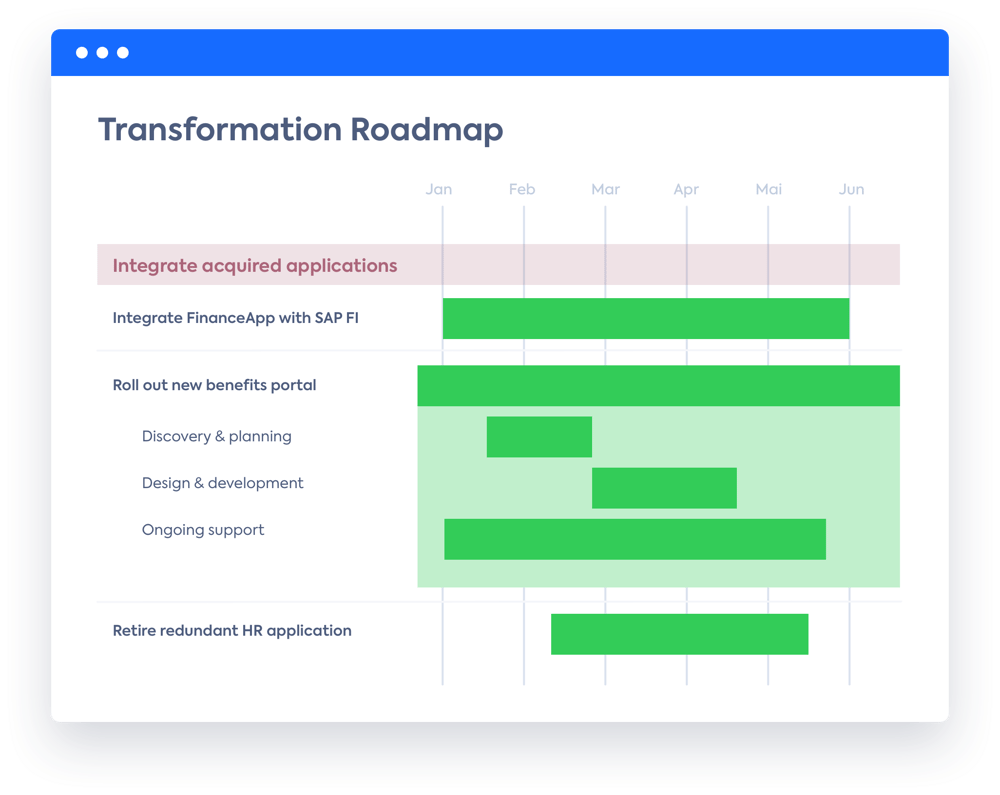

Any PMI will impact business stakeholders, so it’s critical to communicate project timelines and the impacts that will be seen. It’s also essential to track the status of projects, measure their stages of completion, and inform leadership of savings that have been realized. This can be accomplished with the LeanIX Business Transformation Management (BTM) module, an add-on to the Enterprise Architecture Management Platform (see Figure 7).

Figure 7. LeanIX Transformation Roadmap

Source: LeanIX GmbH

With LeanIX BTM, users are able to test different plans and scenarios to aid in identifying the best path forward for post-merger integration. They can also detect dependencies between phase-in and phase-out activities across project timelines. This can be accomplished by looking at the IT landscape at any point in time, past, present, or future, and observing changes.

![Accelerating Change in Enterprises with an EA Management Tool [White Paper]: This white paper will teach you the basics of LeanIX BTM and how to use the module's unique features to build IT roadmaps your whole company can use. »](https://no-cache.hubspot.com/cta/default/2570476/47792d07-0a0c-43e7-861b-87114fed7f03.png)

![Accelerating Change in Enterprises with an EA Management Tool [White Paper]: This white paper will teach you the basics of LeanIX BTM and how to use the module's unique features to build IT roadmaps your whole company can use. »](https://no-cache.hubspot.com/cta/default/2570476/47792d07-0a0c-43e7-861b-87114fed7f03.png)

/EN/White-Paper/Insight_Communication_Engagement_How_EA_Supports_Change_Management_EN-thumbnail.png?width=260&height=171&name=Insight_Communication_Engagement_How_EA_Supports_Change_Management_EN-thumbnail.png)