Imagine the following scenario: Two companies join forces in a “merger of equals.” Both companies have branch offices at the same locations and do very similar business; the purpose of the merger is to significantly increase their market shares in a single sweep. After the due diligence phase and once the deal is signed, the next step is to bring the two companies together on a practical level, and IT integration will play the main role here. The challenges for successful IT integration following a merger are wide-ranging: You have to transform the IT landscape while keeping the company’s business running. Differing technology standards have to be unified, and a wide range of processes and their supporting IT adapted. Assessing the initial situation, such as the extent of each company’s IT, and the type of merger are extremely important in determining the correct way to proceed. Enterprise architects are ideally placed to contribute to the successful integration of two companies, as large parts of the potential synergies in a merger relate to IT. Nonetheless, it is not an easy job, as IT integrations fail for a wide range of reasons.

By focusing on transparently recording the technologies in both companies in order to provide a basis for decision-making, the EA team can contribute significantly to quickly integrating the IT landscapes and thereby generating value for the company in a short time. This blog series shows how enterprise architects can successfully support the post-merger phase of M&As.

M&A REMAINS ON TREND

2015 was a record year for M&A (“Mergers & Acquisitions”): 4.7 trillion US$ were invested in M&A worldwide—even more than the 3.4 trillion US$ in 2014. The convergence of emerging technologies is additionally causing the boundaries between traditional sectors to blur: Banks for example are acquiring financial technology firms in order to make their business capabilities fit for digital consumers, while automobile manufacturers are investing in state of-the-art technologies to upgrade their vehicles with networked hardware. The aims companies pursue with M&A vary: They want to grow, shrink, change their business models or become more competitive. Most companies today are heavily dependent on systems and data that coordinate their transactions, maintain their operations, support sales and customer services. Because information and information processes are now largely handled through IT, IT is a company’s core asset. Progressive digitalization further increases companies’ dependence on innovative and reliable information systems. IT will therefore play an even greater role in post-merger processes in the future than it already does today.

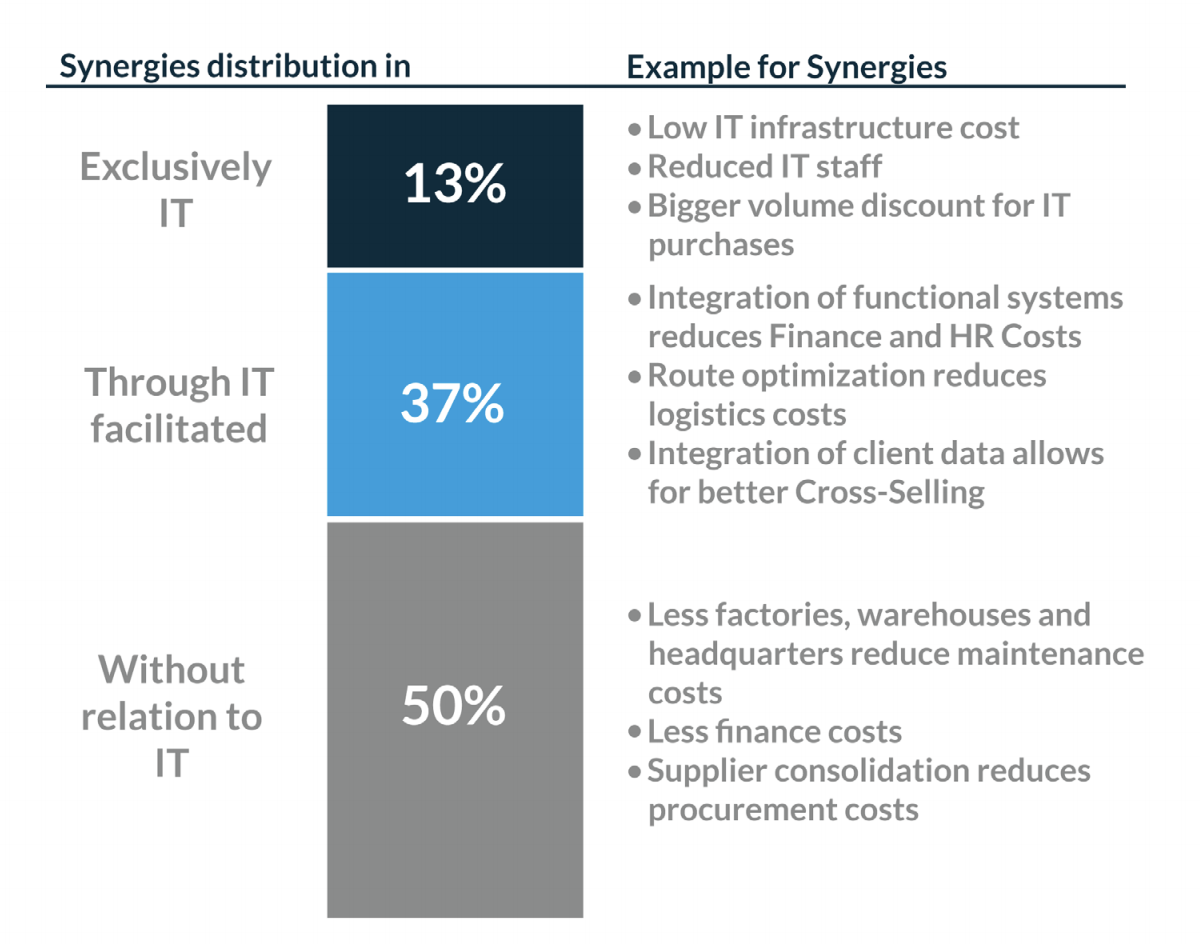

50% of expected synergies are IT-related

M&As often fail because the involved organizations are incapable of successfully integrating with each other, or unable to realize the expected synergies. A survey by Deloitte showed that according to the surveyed managers, almost 30% of post-merger integrations did not have the expected success. Yet companies often plan on IT-related synergies— according to McKinsey, they account for 50–60% of the total projected synergies. This white paper cannot examine all the issues arising in M&A transactions, which is why we are focusing on the section of IT-related synergies that accounts for the largest share at 37%: Synergies in the application landscape. Our scenario is based on the assumption that there are two application portfolios and the intended outcome is a joint target application landscape.

Figure 1: “Synergies distribution in a merger”

METHODS FOR CONSOLIDATING IT APPLICATION LANDSCAPES

Figure 2: “Five step approach to consolidate IT landscapes”

In the following, we employ a number of practical examples to present a model that can be used to plan an IT integration.

1. BUSINESS CAPABILITIES AND USER GROUPS

One of the core views of enterprise architecture is a matrix that assigns applications to user groups and business capabilities. This view makes it possible to assess redundancies and gaps in IT support in both dimensions (functional and usage).

Business capabilities

Begin your M&A integration plan by gaining an overview of the business capabilities of both organizations. Business capabilities structure a company according to its activities. Why should you create capability maps for both companies in the merger? Even if the organizational structures and processes of the two companies are very different from each other, capability maps can help you structure the merger in such a way that they are defined independently of processes and organization. If you assign the applications of both organizations to their business capabilities, capability maps can provide you with initial information on where you have blank spots, where you can consider consolidations and where redundancies can be found.

When creating your business capability map you have to ask yourself how many levels you want to represent within your business capabilities. If in doubt, you should make your capability map broader rather than more in depth. A LeanIX analysis has shown that companies usually map 7–10 business capabilities at the highest level, and 70% of models only have one or two levels. Although you can replicate a better structure with more levels, they also make the model far more complex. If the capabilities of the two companies are very similar, it makes sense to show more hierarchies in order to make the differences between the business capabilities of the two companies clearer.

You will also have to decide whether you want to create a joint capability map for both companies or two different ones. If the business areas of the two companies are very similar, it is useful to have one capability map. If their business areas are very different, it may be more expedient to have two for the transition phase.

Applications can always be assigned to a particular business purpose. Users use them to create value for the company. This makes applications the perfect bridge between business architecture and technology architecture. Link your applications at the lowest level to the business capability they support. Modern enterprise architecture solutions like LeanIX make this easy and provide optimal visualizations.

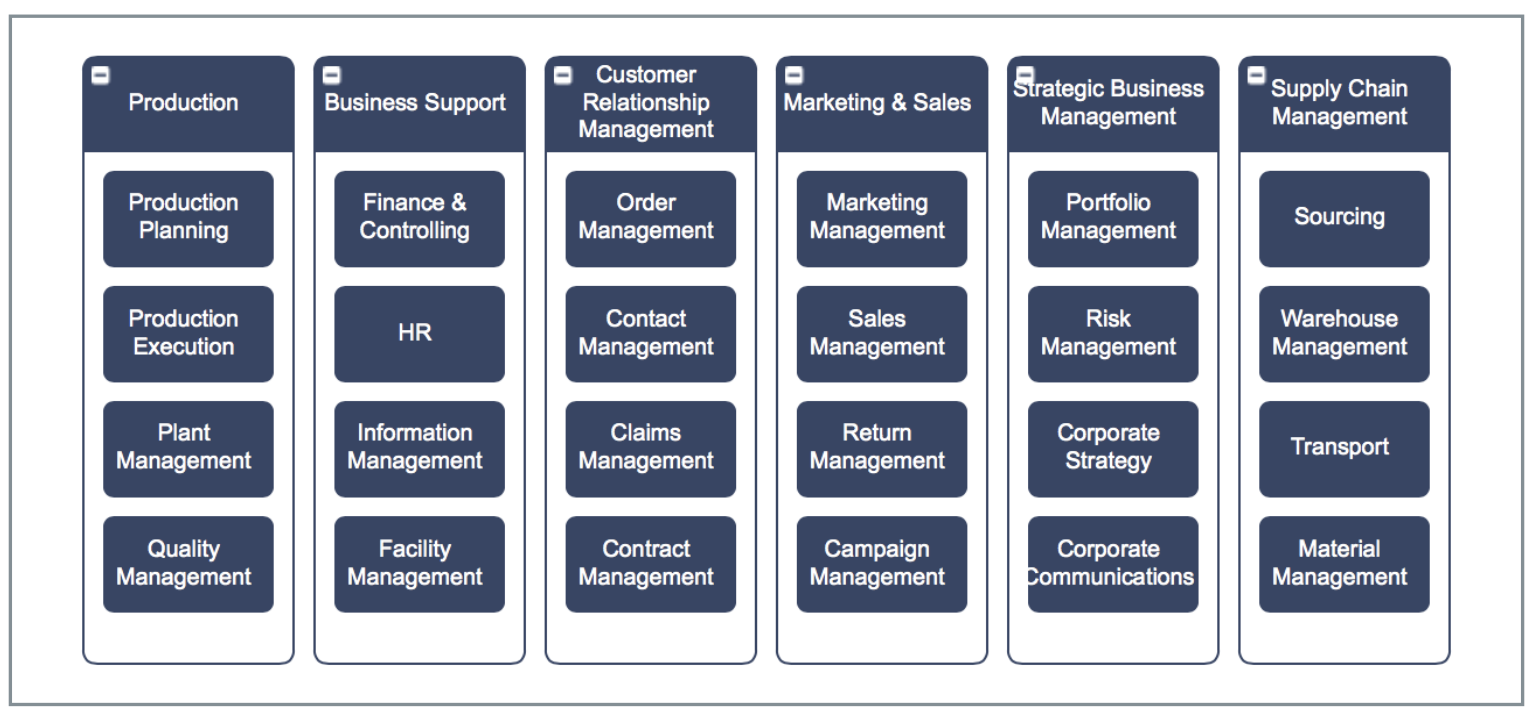

Figure 3: Example of a two level business capability model of a multinational production company

The business capability map also establishes a common language and structure among your stakeholders from various sectors, increasing the acceptance of the M&A project and making the solutions you develop more effective.

User groups

Alongside the business capabilities, it is also necessary to define your user groups. A user group may be for example an organization, a department, a subsidiary or a location. It represents an application’s end users. You can set up different types of user groups in LeanIX in order to examine as many dimensions as necessary.

In a merger you can create the two companies and/ or their locations as user groups. If you choose the location-specific view, you can analyze the application landscape for possible consolidation potential, e.g. by countries. The user groups, in this case the locations, can also be mapped as a hierarchy. This allows more in-depth analyses, e.g. at department level.

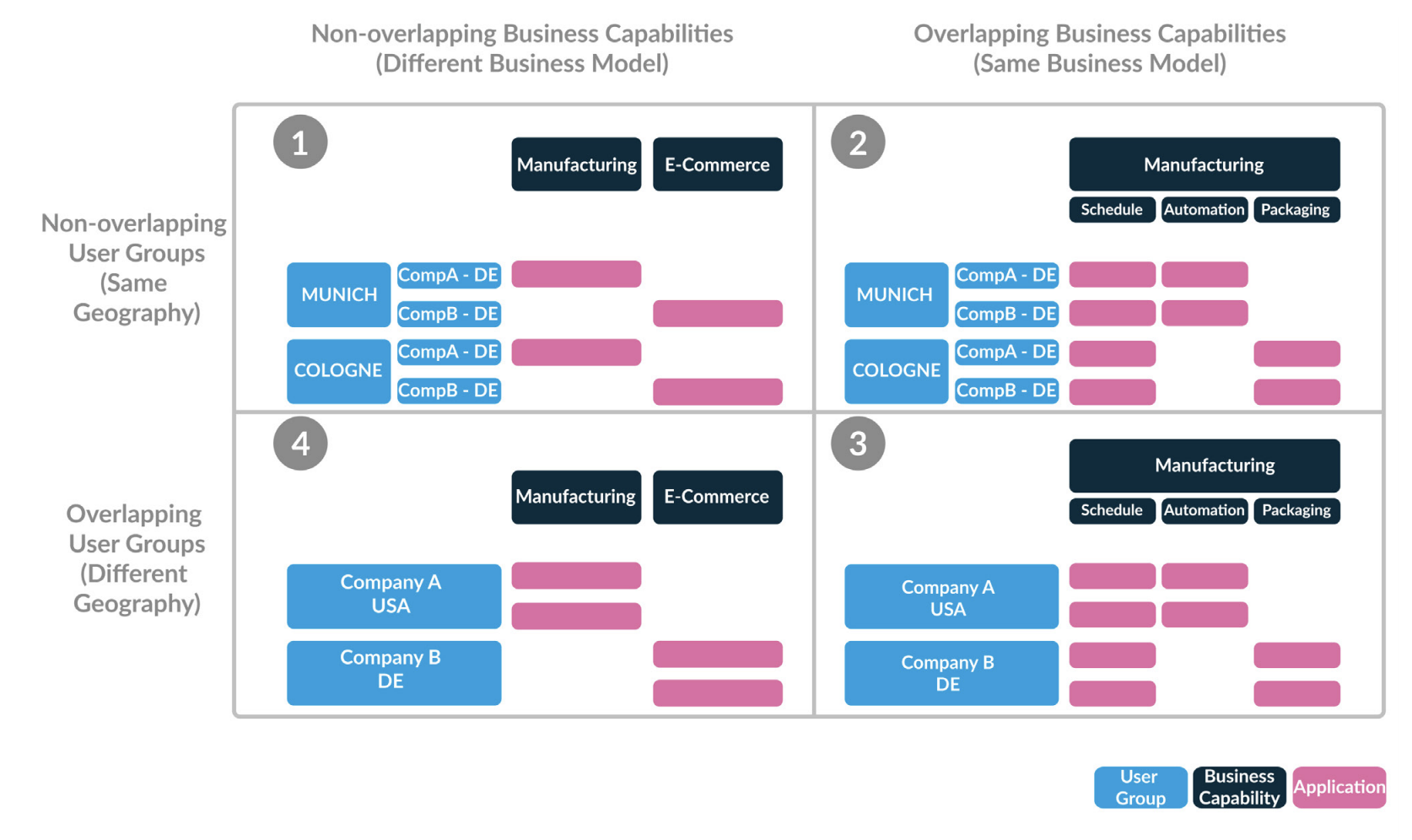

In fig. 4 we have compiled the decisive factors for displaying business capabilities with their applications in connection with user groups. The illustration provides clear recommendations for four generic initial situations. The companies may be similar or differ in two dimensions. The first dimension is that of the business model, which may be similar or entirely different. When two insurance companies merge, their business models and thus their business capabilities will be very similar. In the second dimension you can additionally distinguish for example whether the two companies operate in similar geographic markets. If a Swiss insurance company takes over a different Swiss insurance company, the user groups will be more similar than if it expands e.g. to Italy.

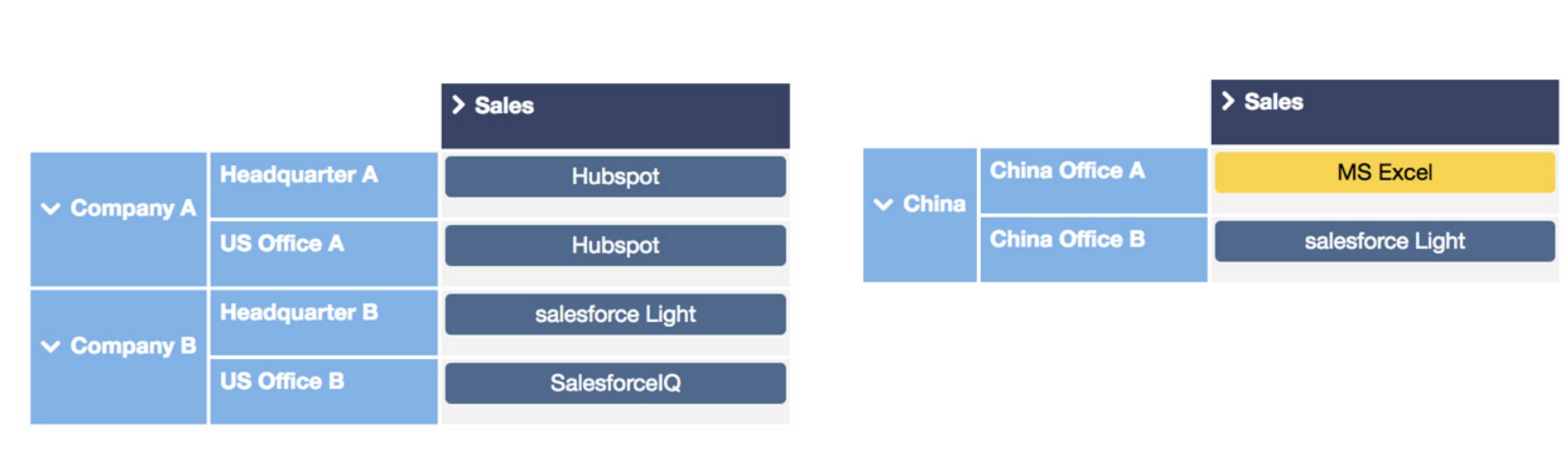

Based on the selected modeling options, different views result. This will quickly become clear from the illustrations below. On the left, the focus is on the “Sales” business capability, and we see the applications that support this capability in all the various user groups (China office, headquarters, US office) in companies A and B. In this view you can analyze applications across the entire company for rationalization potential. The right-hand image focuses on geography; the Business Capabilities and their applications are examined under the aspect of location (China). The application's users outside China are not included in the decision-making process in this view. Both approaches are possible; what is important is that you consider the applications and their dependencies in whichever view you choose.

Figure 5: “Application Matrix modeled by Company (on the left) and by Geography (on the right)."

.png?width=140&height=107&name=BTMPlaybook-FI%20(1).png)